A strategic role in national security and resilience

The county is uniquely positioned to contribute to the UK’s Industrial Strategy and the objectives set out in the Integrated Review and Defence Command Paper Refresh (2023). These strategies emphasise sovereign capability, innovation, and regional resilience, areas where Lancashire excels.

The region’s contribution extends beyond defence to include energy and food security, underpinned by a robust, sustainable rural economy and a network of innovative collaborations.

Lancashire’s industrial base is not only vital to national resilience but also serves as a powerful economic engine for the north west and the UK as a whole.

Defence sectoral strengths and specialisms

Lancashire continues to underpin the UK’s defence and resilience infrastructure. The UK’s ability to build military aircraft, produce nuclear fuel, and develop cutting-edge cyber capabilities is centred in the county. These industries are aligned with the Defence and Security Industrial Strategy (DSIS), which prioritises domestic capability and supply chain security.

According to Oxford Economics (2023)x, BAE Systems’ military air sector, largely based in Lancashire:

- contributed over £5 billion to UK GDP, with £2.6 billion in exports and £220 million in tax revenues

- supported nearly 70,700 jobs across the UK, including 20,000 in the North West

- partnered with 1,400 UK suppliers, returning nearly £2.5 billion to UK businesses

- employed approximately 69% of its workforce in engineering or engineering-related roles, with productivity 15% above the UK average

- supported over 900 apprentices and 320 graduates in 2023, with plans to recruit an additional 300 early-career professionals across its Samlesbury and Warton sites

Nationally, the UK defence sector employed approximately 83,889 full-time equivalent (FTE) workers in 2022, a 1.7% increase from 2021. Of these, 54,000 jobs were supported by domestic defence revenue and 30,000 by international revenue. The north west accounted for 22,298 of these FTEs, with an average salary of £43,738, well above the national manufacturing averagexi.

Innovation and research

Lancashire is home to several major defence and cyber innovation programmes that align with national strategic priorities:

- F-35 Lightning II Programme: A multinational initiative led by the US, with BAE Systems holding a 13–15% workshare per aircraft. Over 1,000 rear fuselage assemblies have been delivered to Lockheed Martinxii

- Global Combat Air Programme (GCAP): A trilateral collaboration between the UK, Japan, and Italy to develop a next-generation combat air system, including the Tempest crewed aircraft and advanced support systems

- National Cyber Force HQ: Set to be permanently based in Samlesbury from 2025, this joint initiative between the Ministry of Defence and GCHQ will support around 2,000 personnel and generate an estimated 3,120 direct and indirect jobsxiii. The Lancashire Cyber Partnership is embedding the NCF within the local economy to drive innovation and job creation

- AUKUS Supply Chain: The SSN-AUKUS submarine programme, a trilateral initiative between the UK, US, and Australia, will replace the Astute class submarines. With manufacturing set to begin later this decade, the programme is expected to peak at 12,000 employees and drive significant infrastructure investment and supply chain development

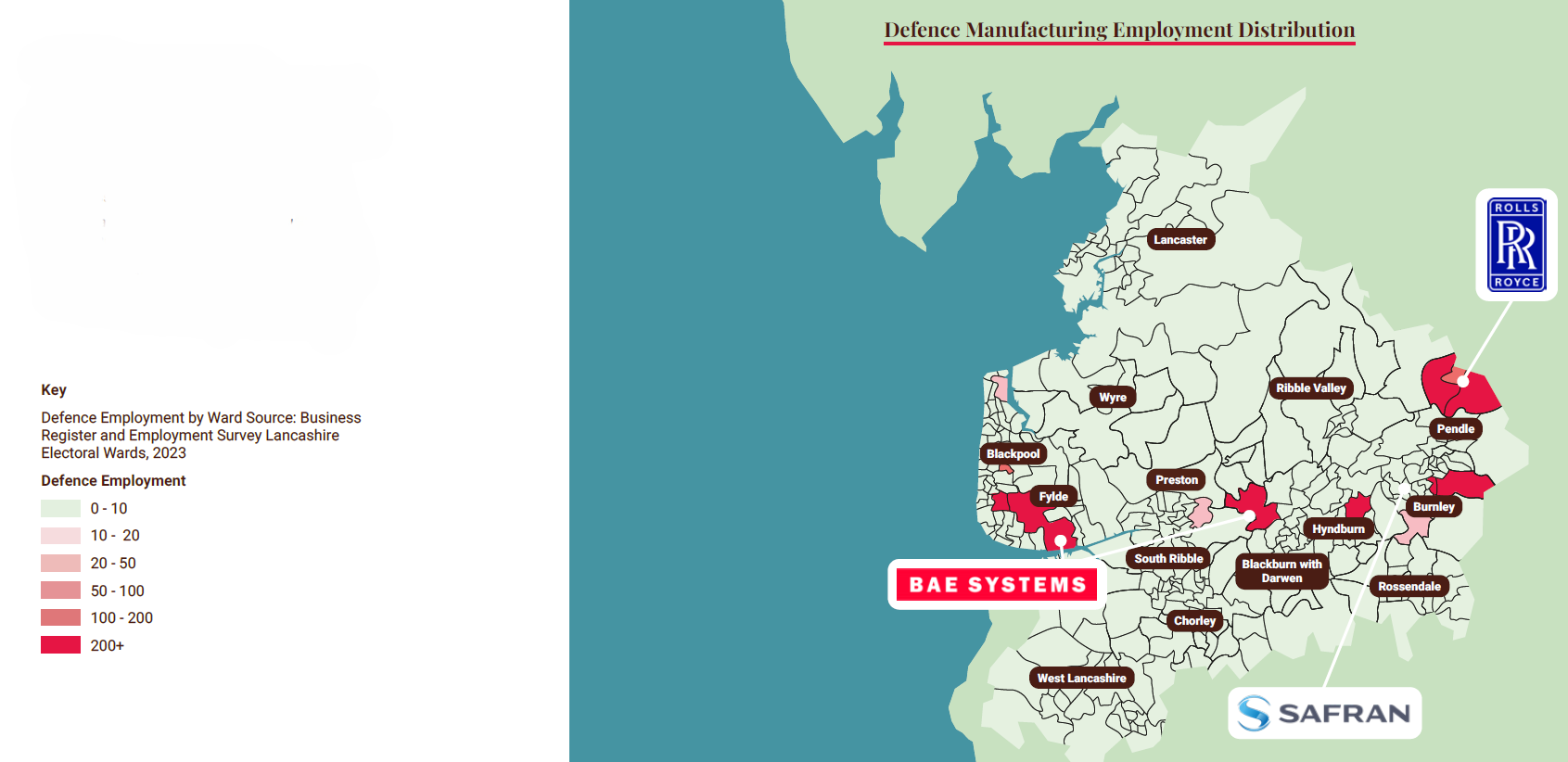

Defence manufacturing employment distribution

Key locations and infrastructure

Lancashire’s defence and security ecosystem is anchored by a network of strategic sites:

- Samlesbury and Warton: Home to BAE Systems’ advanced aerospace operations

- MOD Blackpool: A growing hub for Defence Business Services

- Safran and Rolls Royce: Key contributors to aerospace and propulsion technologies

Case study: MOD strategic relocation to Blackpool

The Ministry of Defence’s relocation of over 1,000 Defence Business Services (DBS) roles to Blackpool represents a major investment in national resilience and local regeneration. A new 53,000 sq. ft. purpose-built office within the Talbot Gateway Central Business District will consolidate DBS operations into a single, MOD-owned site. This move secures long-term civil service jobs, delivers taxpayer savings, and supports the MOD’s £5.1 billion Defence Estate Optimisation programme.

Delivered in partnership with Blackpool Council, Muse Places, VINCI Building, and the Defence Infrastructure Organisation, the project began in May 2025 and is scheduled for completion in 2027.

Transformational projects

- Samlesbury Enterprise Zone and Innovation Hub: Adjacent to BAE Systems and home to the AMRC North West, this site supports advanced engineering, manufacturing, cyber, and robotics. It anchors a wider innovation ecosystem, including the National Cyber Force and regional cyber clusters

- Warton Enterprise Zone and the University of Lancashire Altitude Facility: This future aviation and space technology cluster hosts one of Europe’s largest indoor UAS testing environments. It supports the development of next-generation aerospace, defence, and cyber technologies, driving regional STEM talent development and attracting international investment

Rural economy and food security

With 80% of its land classified as rural, Lancashire’s natural assets are fundamental to the strength and resilience of its agri-food economy. The county supports a diverse and integrated supply chain, from primary production, horticulture, livestock, seafood, food and drink manufacturing, logistics, retail, and tourism.

This robust production capacity and vibrant rural economy makes Lancashire a nationally significant contributor to the UK’s food security and food resilience. West Lancashire is nationally significant for horticulture, producing approximately 20% of England’s field vegetables and salad crops, making it one of the most productive regions outside the Fens. Across the county, the food and agriculture sector supports over 70,000 jobs and contributes more than £2 billion in GVA, representing 10.8% of Lancashire’s workforce, more than double the national averagexiv.

Lancashire has successfully attracted global food and drink brands while nurturing a thriving ecosystem of home-grown enterprises. From West Lancashire’s salad growers and the Fylde Coast’s seafood industry, farms and dairies across Ribble Valley and Trough of Bowland, to major manufacturers across the county, local ingredients flow into national supply chains, serving everything from high-end restaurants to supermarkets, schools, and the visitor economy.

Sectoral strengths and innovation

Lancashire is home to world-class educational and research institutions that are driving innovation in agri-tech and sustainable food systems, not only improving productivity and resilience within our food chain but also creating a circular economy impacting on the use of natural resources in the region which has benefits beyond the food sector. These include Myerscough College near Preston, a national leader in agricultural education, applied farming research and land-based expertise; the Lancaster Environment Centre, one of the world’s largest environmental research centres; Edge Hill University’s Greenhouse Innovation Consortium and Plant Science unit, which addresses plant production challenges across the north west; and the University of Lancashire, which is advancing the “One Health” approach by integrating human and animal health innovation.

These assets, combined with Lancashire’s cross-sector strengths in advanced engineering, cleantech, low-carbon technologies, drone systems, and data science, provide a strong foundation for a modern, sustainable, and high-value agri-food industry. This will not only enhance national food security but also drive exports, stimulate innovation, and attract inward investment.

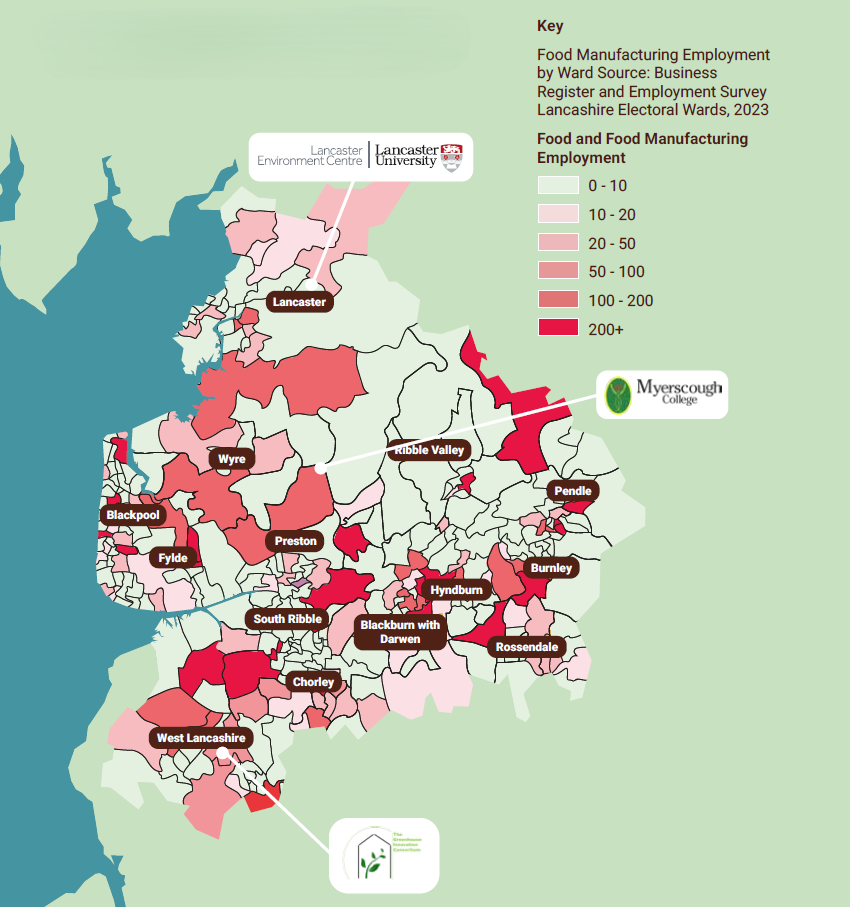

Key locations and infrastructure

Lancashire’s food and agriculture sector is supported by a network of strategic institutions and innovation centres. The Food Security Employment Distribution Map highlights key locations such as Lancaster University’s Environment Centre, Myerscough College, and the ECHoLiGHT facility as part of the Greenhouse Innovation Consortium at Edge Hill University. These institutions form the backbone of Lancashire’s rural innovation ecosystem.

Food security employment distribution

Case study: Butlers Cheeses Campus

Following a fire in 2024, Butlers Cheeses, a fourth-generation, family-run cheesemaker based in rural Lancashire, announced the development of a new, state-of-the-art cheesemaking campus. This facility will be among the most advanced foster innovation while remaining rooted in the local landscape. The project will create a wide range of skilled jobs and has already led to a 40% reduction in food miles through the engagement of additional local suppliers.

Growth Plan projects supporting food security

The Greenhouse Innovation Centre at Edge Hill University and the Rural Innovation Centre are complementary projects designed to boost These initiatives will support applied research, agri-food sector, helping to future-proof the rural economy and align with national priorities for food security and net zero.